See better. Feel better.

See clearly now, then make predictable payments later when you use Paytient for the whole family’s vision expenses2. Whether it's new specs, surgery, or a vision test, you can keep an eye on your finances and choose a repayment plan that fits your budget.

Important note for our members: The specific types of care categories where your Paytient card can be used (like medical, dental, vision, pharmacy, or vet services) are determined by your employer's or health plan's specific Paytient program. Please log in to determine where you’re eligible to spend.

Pay your way for the care you need.

Whether you’re at the eye doctor or browsing for glasses online, you can use your Paytient card at merchants like —

Use Paytient for…

- Prescription glasses

- Contacts

- Prescription sunglasses

- Exams and vision tests

- Surgeries and procedures

- Blue light blocking glasses

- Reading glasses

...and more!

But not for…

- Non-prescription or non-corrective glasses

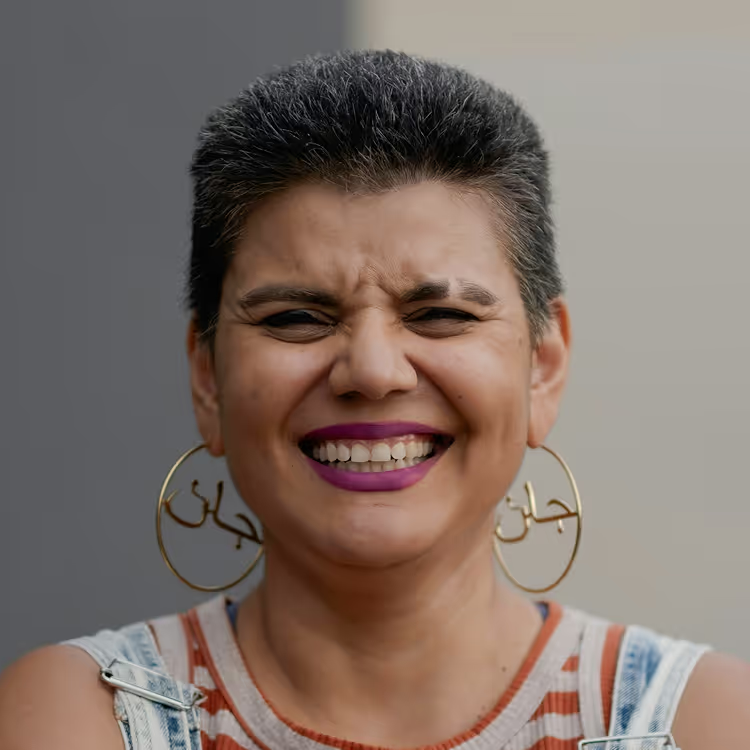

These members protected their eyesight with Paytient.

FAQ